S Alam, The Corporate Looter: Steal and Divide

S Alam Group, accused of looting banks, has taken out at least Tk2 lakh crore or over $100b anonymously from various banks, including those under its control, and laundered most of it abroad. The current governor of BB, Ahsan H Mansur has stated that "I'm not aware of anyone else in the world who has executed a bank robbery in such a well-planned manner".

Now, the question is, when did this looting begin in the first place?

In 2013, after arresting different members of Harkat-ul-Jihad, a campaign emerged accusing Islami bank of financing terrorism groups, which led prominent figures, including the chairman of a Sonali bank, to urge Prime Minister Sheikh Hasina to reconsider the bank’s alleged connections. This effort to control Islami Bank gained traction after the Awami League’s re-election in January 2014, which was a one-party election as big opposition parties such as BNP boycotted the elections. By 2016, the central bank approved the appointment of four independent directors to Islami Bank. During the same period, S Alam Group began acquiring shares through seven newly registered paper-based companies. This acquisition, totaling around 100 crores in bank shares, enabled S Alam Group to secure directorships and a strong position on the bank’s board. S Alam Group acquired approximately 20% of Islami Bank’s shares by buying from the stock market and sponsors who were selling off their stakes due to anticipated challenges. The paper-based companies were:

- Excel Dyeing and Printing Limited

- Armada Spinning Mills Limited

- ABC Ventures Limited

- Grand Business Limited

- Platinum Endeavors

- Paradise International Limited

- Blu International.

Corporate Coup

On January 5, 2017, Firstly DGFI operatives detained Islami Bank's chairman, vice-chairman, and managing director from their homes and took them to DGFI headquarters in Dhaka.

Therefore, The DGFI officers presented resignation letters, which the bankers were forced to sign.

Thirdly, later that day, under the watch of intelligence officers at the Radisson Blu Hotel, the board appointed new leaders with help from central bank officials: Arastoo Khan of Armada Spinning Mills as chairman and Md Abdul Hamid Miah the former managing director of Union Bank as managing director of Islami Bank.

Lastly in that same day, the Islamic Development Bank, a major sponsor with a 7.5% stake in Islami Bank, sold about 5% of its shares due to the sudden changes.

What was Awami League’s benefit?

The former private sector development adviser to Sheikh Hasina and the vice chairman of BEXIMCO group, Salman F Rahman stated during an interrogation that S. Alam smuggled nearly 1.5 trillion taka or 15 Billion USD or out of the country and Half of the BDT 1.5 lakh crore that were smuggled out of the country through S. Alam have been transferred to Sheikh Rehana and Sajeeb Wazed Joy, the sister and son of the former prime minister Sheikh Hasina.

S Alam’s Loot, The Corporate Theft?

The Bangladesh central bank has permitted 17 companies to invest internationally, but S Alam was not among them. Despite this, S Alam has purchased at least two hotels, two homes, one retail space, and other properties in Singapore over the past decade, while attempting to obscure his ownership from documents. As of January 2023, the central bank has approved about USD 40.15 million for overseas investments, according to a BB document. This amount is significantly 10% of the over USD 411.8 million S Alam has spent on just two hotels and one retail space in Singapore since 2009.

2009 - Opens Canali Logistics

2014 - Canali buys 328-room Hotel Grand Chancellor for USD177m in cash

2016 - Alam and his wife buy an investment company in Cyprus

2016 - Canali acquires 27,000sqf retail space for USD 100.53m

2017 - Canali Logistics renamed Wilkinson International

2019 - Buys hotel Ibis Novena for USD 125.6m

2020 - Alam and his wife transfer all their shares in their Singaporean company Wilkinson to a company called Peacock Property in British Virgin Islands

2022 - Transfers ownership of two homes to two private Trusts, and it masked names of actual owners

In 2016, S Alam acquired a company called ACLARE Investment Ltd in Cyprus, a tax haven. The company was subsequently renamed ACLARE International, as indicated by documents from Cyprus' Department of Register of Companies and Official Receiver.

Loans - Emptying six banks

S Alam Group and its affiliates borrowed BDT 95,331 crore from six banks between 2017 and June of this year, with Islami Bank providing 79 percent of the funds. As of March, this amount accounted for 5.78 percent of all loans outstanding in the banking industry.

A small corrugated tin vendor named Murad Enterprise obtained BDT 890 crore within a month of opening an account at the Islami Bank branch in Chaktai. However, the company's financial needs and repayment capacity were not adequately examined.

A year later, the company, a front for S Alam Group, was granted another BDT 110 crore loan.

Since June of last year, S Alam Group and its affiliated companies have borrowed a total of BDT 74,900 crore from Islami Bank, which is chaired by Ahsanul Alam, Saiful Alam's eldest son.

BDT 26,000 crore of this total was borrowed through subsidiaries, and the remaining amount was borrowed through 29 affiliated businesses, such as the Nabil Group, Desh Bandhu Group, Unitex Group, and Anantex Group.

| Company Name | Amount in Tk | Banks |

|---|---|---|

| Nabil Group, Desh Bandhu Group, Unitex Group, Annatex Group (in total 29 subsidiary companies) | Tk 26,000 crore | Islami Bank |

| S Alam Group and its 10 shadow companies | Tk 35,924 crore | Islami Bank |

| Nabil Foods, Nabil Auto Rice Mills, MS AJ Trade International, and Anowara Trade International | Tk 29,575 crore | Islami Bank |

| Through Islami's offshore banking unit | Tk 23,900 crore | Islami Bank |

| S Alam subsidiaries | Tk 10,449.45 crore | Janata Bank’s Sadharan Bima Corporate Branch in Chattogram |

| Alam's siblings Halima Begum, Osman Goni, and Md Rashedu Alam and his wife Marzina Sharmin | Tk 2,000 crore | Union Bank |

| Alam's daughter Maimuna Khanam. Seven other relatives of Alam, including his brother Shahidul Alam and sister Rokea Yasmin | Tk 574 crore | Global Islami Bank |

| Alam himself. Alam's wife, Farzana Parveen | Tk 257 crore | First Security Islami Bank (FSIBL) |

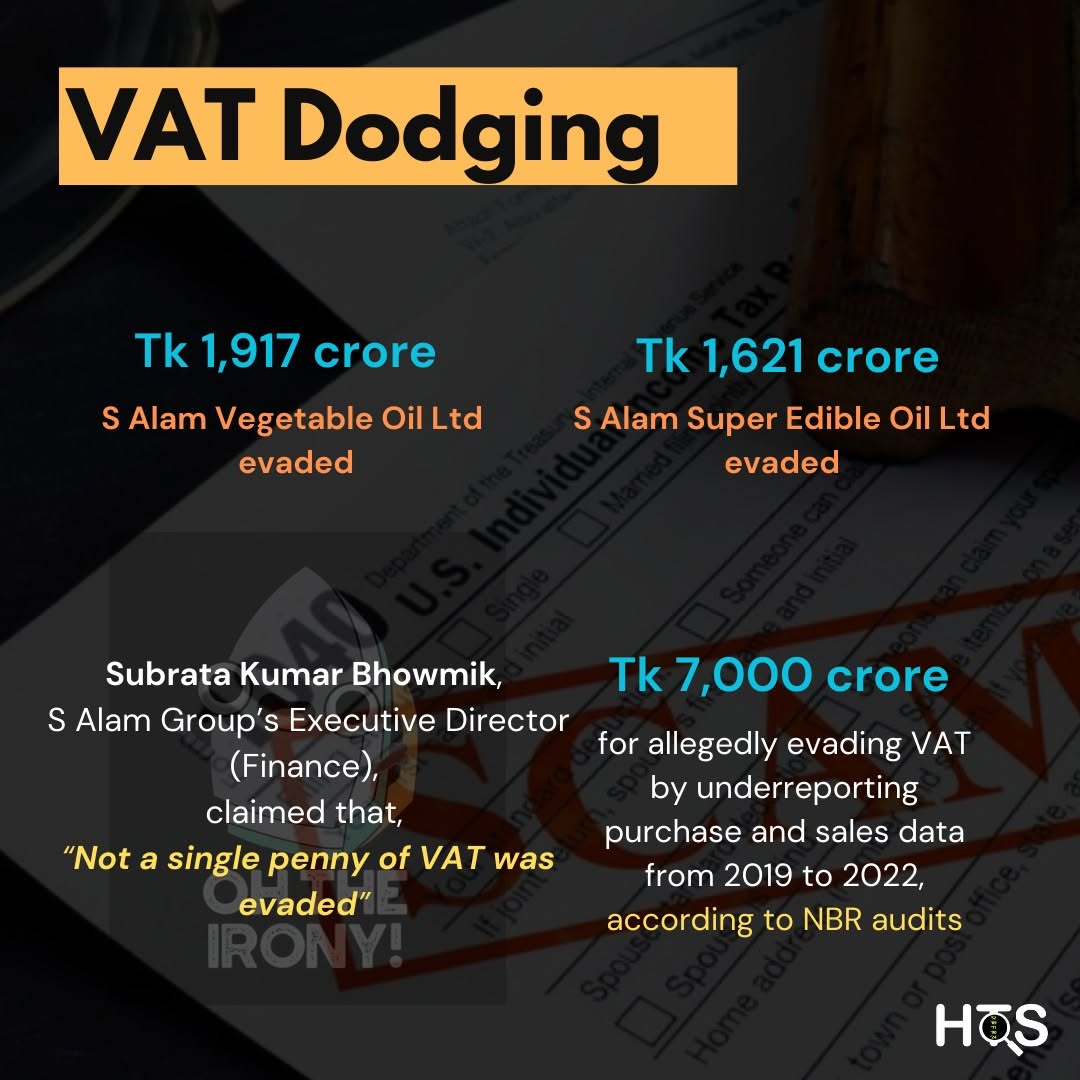

VAT dodging of S Alam

S Alam Vegetable Oil Ltd and S Alam Super Edible Oil Ltd face unpaid VAT and penalties exceeding BDT 7,000 crore for allegedly evading VAT by underreporting purchase and sales data from 2019 to 2022, according to NBR audits. The audit, reported in October 2023 and reviewed in May 2024, found that S Alam Vegetable Oil Ltd evaded BDT 1,917 crore and S Alam Super Edible Oil Ltd BDT 1,621 crore. Despite this, Subrata Kumar Bhowmik, S Alam Group’s Executive Director (Finance), ironically claimed that “Not a single penny of VAT was evaded” and they will appeal the findings.

HC’s Blind Treatment to S Alam

The bench of Justice Md Nazrul Islam Talukder and Justice Kazi Ebadoth Hossan of High court reversed its own decision to look into loan disbursements of the state-owned banks for political pressures. The High Court has permitted the Anti-Corruption Commission (ACC), Bangladesh Bank, Bangladesh Financial Intelligence Unit, and the Criminal Investigation Department (CID) to investigate any irregularities that may exist. However, at the same time it has ruled that the ACC and CID are not required to submit reports following their inquiries into the allegations. It seemed like the High Court wanted to unsee Alam’s robberies. Khurshid of the ACC reported that Justice Md Nazrul Islam Talukder, a senior member of the High Court bench, reprimanded him for opposing the order to dismiss the case.

The Appellate Division overturned the High Court’s suo motu order to investigate S Alam Group chairman Mohammad Saiful Alam and his wife Farzana Parveen's alleged money laundering and offshore investments of BDT 11,000 crore. Chaired by Chief Justice Obaidul Hassan, the six-judge bench noted that the ACC and Bangladesh Financial Intelligence Unit could still pursue inquiries if deemed necessary. The Appellate Division criticized the ACC for not investigating the allegations following a report by The Daily Star titled "S Alam’s Aladdin’s Lamp." The court nullified the High Court’s ruling and directive, based on the report’s claims of unauthorized offshore investments. It looked like both the HC and Appellate Division were trying to save S Alam’s crimes instead of investigating a single penny.

Sources

- How Islami Bank was quietly taken over | The Business Standard

- Over $100b believed to be laundered, swindled during Hasina regime | CA Office

- S Alam took out 20,547C as loans from Islami Bank | Dhaka Tribune

- S Alam group, associates: BDT 95,000cr loans taken from 6 banks | The Daily Star

- Two S Alam firms evaded Tk 3,500 crore in VAT, says NBR | The Daily Star

- S Alam's Aladdin's lamp | The Daily Star

- SC voids HC suo moto rule | The Daily Star

- HC rejects probe order against S Alam | The New Age